Understanding

Bitcoin & Mining

Bringing you up to speed

The average weekly stablecoin transaction volume in 2025 reached $521 billion, with total annual blockchain transactions surpassing Visa’s volume.

What Is Bitcoin Mining?

Bitcoin mining is the process by which transactions are officially entered on the blockchain; a decentralized, digital ledger that securely records transactions in a chain of “blocks”. Once a block is added, it’s permanently linked to the previous one, creating a permanent, transparent, and tamper-proof history of all transactions, as altering one block would require altering all subsequent blocks on the entire network, which is nearly impossible.

Miners use hardware and software to generate a cryptographic number that is equal to or less than a number set by the Bitcoin network’s difficulty algorithm. The first miner to find a solution to the problem receives bitcoins as a reward, and the process begins again. Winning a block is probabilistic. A miner’s chance equals their hash rate divided by total network hash rate, which is why miners tend to work in pools to increase that probability.

What is Halving?

Bitcoin halving is a pre-programmed event that occurs approximately every four years, or after every 210,000 blocks are added to the blockchain, and is designed to control the inflation rate and ensure scarcity, similar to precious metals like gold. For example, the last halving on April 20, 2024, reduced the reward from 6.25 BTC to 3.125 BTC per block.

By reducing the rate at which new bitcoins enter circulation, halvings decrease the overall supply growth. Historically, halvings have been followed by periods of increased investor attention and significant bullish price cycles.

Market & Industry Analysis

Crypto currency is now recognized as currency and has legal certainty.

The United States has taken a decisive step that reshapes its financial architecture. The GENIUS and CLARITY Acts have removed stablecoins and major crypto assets from the legal "gray zone," officially recognizing them as digital dollars and commodities in the same class as gold and wheat.

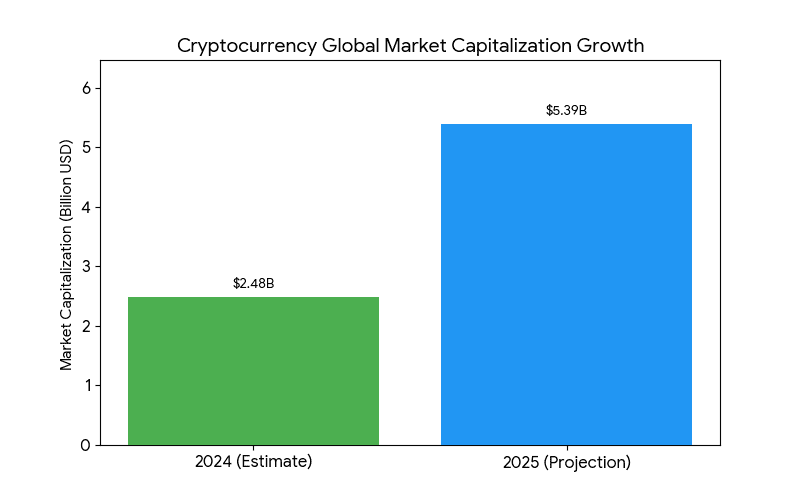

According to Reuters, the total cryptocurrency market capitalization reached $4 trillion on July 18, 2025, following the adoption of the GENIUS Act.

Institutional capital has effectively entered the market.

$33 Trillion in transactions in the past 12 months.

Financial giants are already adapting. PayPal now supports over 100 cryptocurrencies, Visa and Mastercard are launching stablecoin integrations, and the White House is forming a strategic reserve of 200,000 BTC. The transformation of global financial infrastructure is already underway.

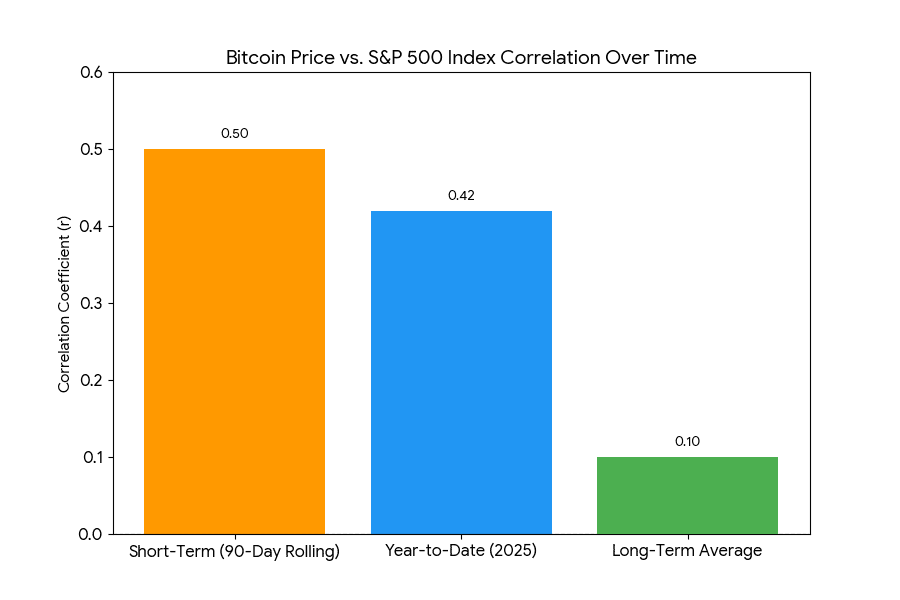

| Short-Term (90-Day) | 0.50 |

| Year-to-Date (2025) | 0.42 |

| Long-Term Average | 0.10 |

| Short-Term (90-Day) | 0.50 |

| Year-to-Date (2025) | 0.42 |

| Long-Term Average | 0.10 |